How To Make a Will in Queensland (2025 Guide)

A Step-By-Step Guide to Creating a Last Will and Testament In Queensland

Create a legal Will in Queensland to protect your assets and loved ones. Under the Succession Act 1981 (QLD), anyone over 18 with testamentary capacity can write a Will. If you’re ready to Make a Will Queensland, this guide explains each step—from drafting your document to signing it with valid witnesses—so you can feel secure about your final wishes.

Why make a Will in Queensland?

A Will is an important legal document that outlines how you distribute your property after death. It also lets you decide key matters for your family’s future. Beyond transferring assets like property and funds, a Will allows you to name guardians for minor children, ensuring their well-being if you’re no longer there.

Without a Will, the state of Queensland applies intestacy rules that may not align with your wishes. By choosing to Make a Will in Queensland, you stay in control of who inherits your estate and how it’s managed.

Legal Requirements to make a Valid Will in Queensland

To make a Will in Queensland, follow these essentials under the Succession Act 1981 (Qld). If you ignore them, a court may treat your Will as invalid, complicating probate:

You must be at least 18 years old. If you’re married or receive corut’s permission, you may make a Will before 18.

Have testamentary capacity. You must understand what a Will is, know your assets, and recognise who might have a claim on your estate.

Put it in writing. Queensland law doesn’t accept oral Wills. Prepare a physical document (typed or handwritten) and be sure to sign it in front of two witnesses.

Sign with Two Witnesses. The testator (person making the Will) signs, and two competent witnesses watch simultaneously. While a beneficiary can legally witness, it may cause added legal steps—so choosing disinterested witnesses is best.

By meeting these requirements, you help ensure your estate goes to the people you intend. If your Will fails to comply, the courts could invalidate it, leaving your assets subject to Queensland’s intestacy rules.

Step-by-Step: How to Make a Will in Queensland

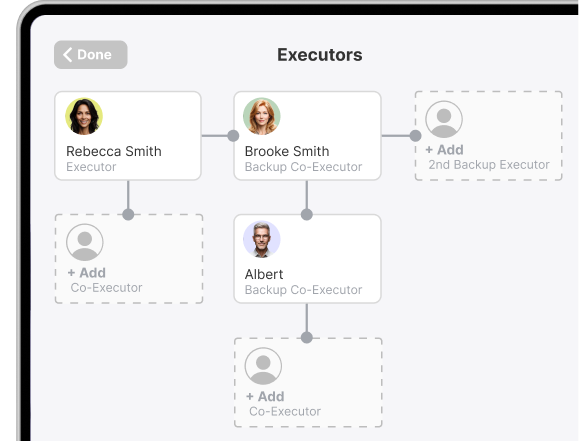

1. Choose an Executor

Your executor carries out your Will in Queensland once you pass away. This includes distributing assets according to your wishes, settling any debts, and managing legal tasks—such as applying for probate in the Queensland Supreme Court.

When you select an executor, choose someone who’s organized, trustworthy, and ready to take on these duties. Many people pick a family member, close friend, or professional advisor. You can name multiple executors to carry out these tasks (Co-Executors).

It’s also wise to name a backup executor if your first choice can’t serve. By planning this step when you make a Will in Queensland, you help ensure a smooth estate process.

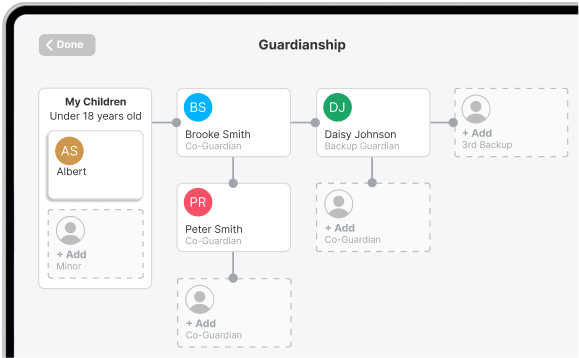

2. Name a Guardian for Minor Children

When you make a Will in Queensland, consider naming a guardian to care for any minor children if you pass away. This guardian manages daily decisions about education, healthcare, and overall well-being.

Although it’s optional, many parents see it as essential. If you don’t name a guardian, a Queensland court appoints one—potentially clashing with your wishes.

It’s also wise to choose a backup guardian in case your primary choice can’t serve. By planning this step, you keep control of your children’s future, even if you’re no longer there.

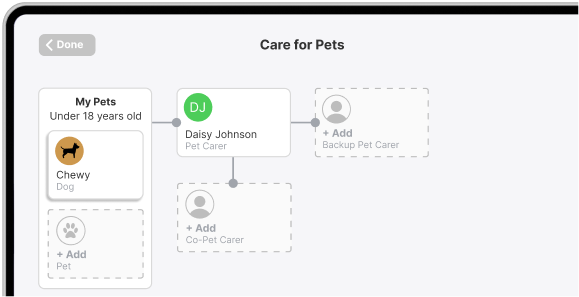

3. Name a Pet Carer

When you make a Will in Queensland, consider including instructions for your pets. Appoint someone to look after them and allocate funds for their care. This step ensures your furry friends stay safe and well‐provided for, even if you’re no longer around.

Although optional, this move matters if you want to control your pets’ future. If you don’t name a pet carer or guardian, either a Queensland court or your executor could decide who takes on that role—which might not match your wishes.

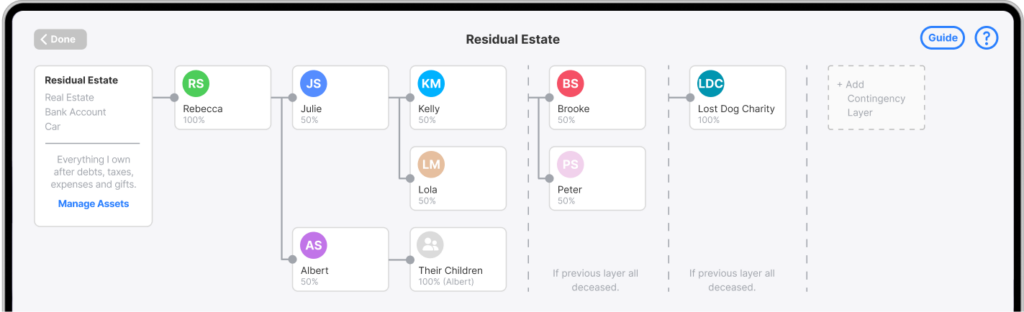

4. Decide who inherits your Residual Estate

Your residual estate includes whatever remains after you pay debts and taxes and distribute specific gifts. Choose one or more beneficiaries—family, friends, or charities—to receive these assets. For clarity, list each beneficiary’s full name and note the exact share they get.

It’s also wise to name backup beneficiaries in case your primary choices can’t inherit. By clarifying this step when you make a Will in Queensland, you reduce confusion and ensure your wishes are carried out exactly as you intend.

5. Gifting Specific Items

If you own items or assets—like a family heirloom, jewellery, property or cash—and want certain people to receive them, list these items in your Will. Include enough detail (e.g., descriptions or photos) to avoid disputes. Before you make a Will in Queensland, consider inventorying all your assets so you know exactly what you’re gifting.

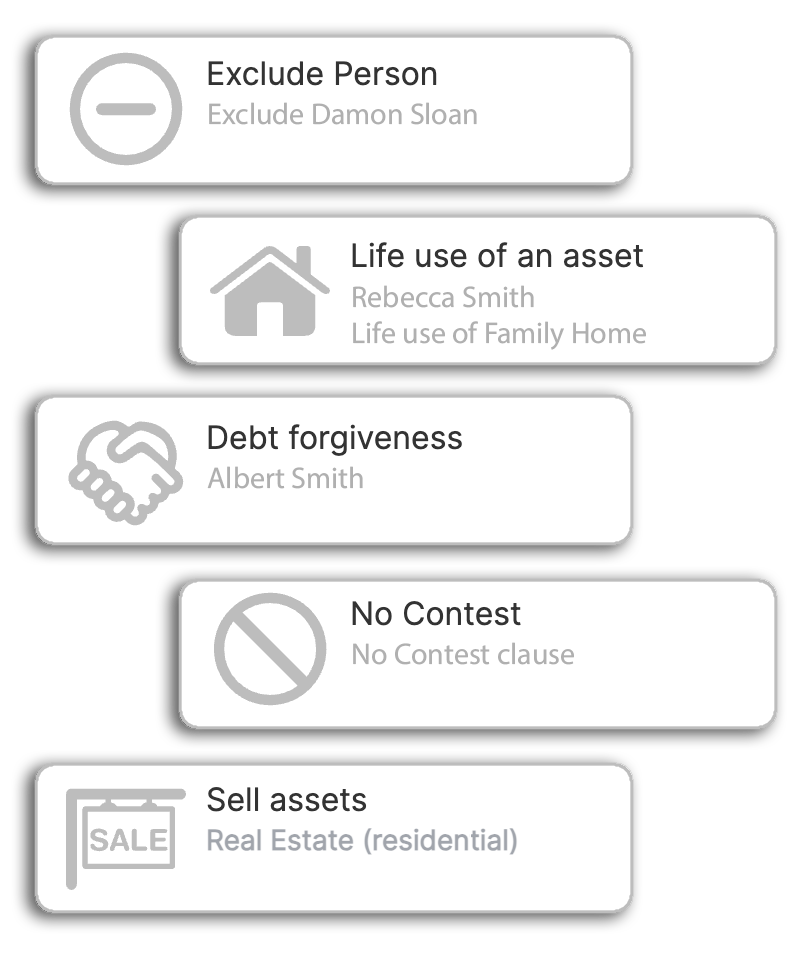

6. Any Additional Instructions or Provisions?

You can add optional clauses, such as funeral preferences or instructions to sell certain assets. You might make a gift conditional or create a trust until beneficiaries reach a specific age. By detailing these provisions when you make a Will in Queensland, you ensure your wishes remain clear and enforceable.

Review Your Will

Confirming Roles in Your Will

Before you finalise your Will, ensure each chosen Executor, Guardian, and Pet Carer accepts their role. Doing so prepares them for their duties and helps you avoid surprises.

It’s wise to discuss these responsibilities with everyone you nominate (and their backups) so they’re comfortable fulfilling them. By clarifying roles when you make a Will in Queensland, you minimise confusion and keep the process smooth.

Executors

Guardians

Pet Carers

Test Your Will

Before you finalise your Will, consider potential scenarios—like a beneficiary passing away first or certain conditions going unmet. Visualise how your wishes might unfold under various circumstances, and adjust your Will if necessary. This extra step ensures your plan accounts for every possibility.

Signing Your Will

Signing Your Will In Front of Witnesses

After you draft your Will, print and sign it as the next crucial step. When you make a Will in Queensland, follow these rules to ensure validity:

Witness Requirements

- Have at least two witnesses watch you sign the Will simultaneously.

- They must be 18 or older and understand they’re witnessing your signature.

- Although Queensland law allows a beneficiary to witness, doing so may add extra legal steps—so it’s best to use disinterested witnesses.

Once you sign, both witnesses must also sign, confirming they saw you and that you appeared to have capacity (sound mind).

Is Notarisation Required?

You don’t need a notary for Wills in Australia, including Queensland. As long as your Will meets the witness requirements, the Court accepts it as valid without a seal or stamp.

What about Online Wills in QLD?

If you use any Online Will platform in Queensland to make your Will, it is essential that your Will is printed and signed according to these instructions. Having a Will online in Queensland that has NOT been printed and signed will not be considered valid.

Storing Your Will

Keep Your Will Safe

After you sign and witness your Will, store the original copy in a secure spot. In Queensland, only that signed document holds legal force—digital versions don’t qualify. If you lose or damage it, your loved ones might face extra hurdles distributing your estate.

Queensland doesn’t maintain an official registry for living people’s Wills. When you make a Will in Queensland, consider these secure storage options:

Store at Home

Keep your Will at home or give it to a reliable friend or family member. Make sure they know how important it is to safeguard the original.

With an Attorney

If you worked with a lawyer, they can offer to store your Will in a secure location.

Trusted Person

You can also leave your Will with a trusted individual who understands its value and will protect it from loss or damage.

Although online wills in QLD (digital copies) are handy for reference, only the original signed Will carries legal weight in Queensland. Be sure your executor knows exactly where to find it to avoid complications.

FAQs: Making a Will in Queensland

1. What Are My Options for Creating a Will in Queensland?

In Queensland, you have several ways to make a Will:

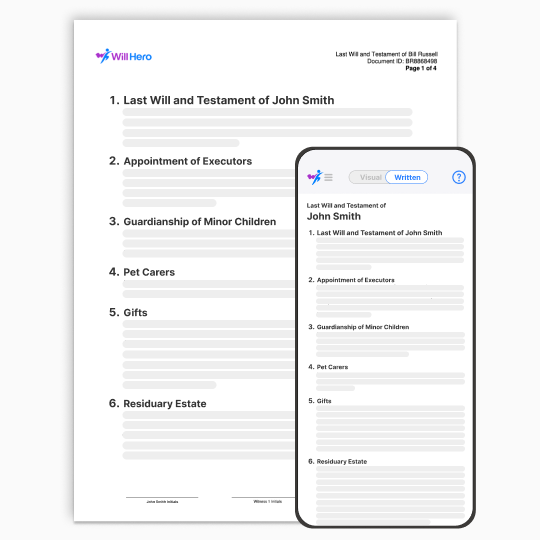

- Use an Online Will Platform: For simpler estates, a service like Will Hero provides an affordable, convenient path to a valid Will online in QLD. Our visual interface walks you through each step to cover all essentials.

- Hire a Lawyer: If your estate is large or complex, or if you need personalized legal guidance, a solicitor can help with tax planning, trusts, and specialized issues.

- Handwrite Your Will: You can draft a physical Will by hand, as long as you sign it in front of two witnesses. (See FAQ #3 for more details on handwritten Wills.)

2. Do I Need a Lawyer to Make a Will in Queensland?

No. You don’t have to hire a lawyer to create a valid Will in Queensland. If your affairs are straightforward and your wishes are clear, an online or handwritten Will often suffices. However, if your estate is complex or you’re worried about tax planning or trusts, consulting a legal professional can provide extra peace of mind.

3. Are Handwritten Wills Valid in Queensland?

Yes. When you make a Will in Queensland, you can handwrite it, provided you follow the correct steps. Under the Succession Act 1981 (Qld), the testator must sign any typed or handwritten Will in front of two witnesses who watch simultaneously.

If your handwritten Will fails to meet these requirements, the Queensland Supreme Court may invoke its “dispensing power” to declare it valid. However, that process is uncertain and can be costly. To avoid issues, use two independent witnesses from the start, regardless of how you create your Will.

4. Is there Any Inheritance Tax in Queensland?

Australia, including Queensland, doesn’t impose inheritance or estate taxes; “death duties” were abolished decades ago. However, you may incur capital gains tax (CGT) if you sell an inherited asset at a profit.

Death itself doesn’t automatically trigger a tax, but if you have complex property or investments, consult a tax professional. That way, you’ll understand any potential CGT or other implications before you make a Will in Queensland.

5. Do I Need to Notarise My Will in Queensland?

No. In Queensland, you don’t need a notarised Will for it to be valid. Simply sign your Will in front of two witnesses, and have them sign too. That’s enough for legal recognition.

6. Can I Change My Will After It’s Signed?

Yes. As long as you have sound mind, you can update your Will whenever you like. Generally, you have two choices:

- Add a Codicil: This amendment modifies your existing Will. Sign and witness it just like the original.

- Create a New Will: Draft a fresh document that revokes all previous Wills and codicils. After signing, destroy every old copy to avoid confusion.

7. What Happens if I die without a Will in Queensland?

If you pass away without a Will in Queensland, state intestacy laws dictate who inherits. Usually, your closest relatives receive your assets. If you have no immediate family, the state may claim your property.

If you have minor children, the court chooses their guardian, which can contradict your preferences. By choosing to make a Will in Queensland, you keep control over these important decisions.

8. What is Probate?

Probate is the legal process that begins after someone dies. It confirms a Will’s validity and ensures the estate follows that Will—or, if none exists, Queensland’s intestacy laws.

In Queensland, the Supreme Court (via its Probate Office) grants probate. Typically, the executor applies for a Grant of Probate. The process usually includes:

Filing the Will

The executor files the Will with the Supreme Court of Queensland, along with a petition to open probate. If there’s no Will, they submit a petition for intestate succession.Appointing an Executor

If a valid Will names an executor, that person manages the estate. If the Will lacks one—or if no Will exists—the court appoints an administrator.Inventory of Assets

The executor identifies and values the deceased’s property, such as bank accounts, investments, personal belongings, and debts.Paying Debts and Taxes

Before distributing the estate, the executor settles all debts, taxes, and expenses (like mortgages or medical bills).Distributing the Estate

Once debts are paid, the executor distributes remaining assets to beneficiaries named in the Will. Without a Will, the estate passes to heirs under Queensland’s intestacy rules.Closing the Estate

After meeting all obligations, the executor files a final petition to close probate.

When you make a Will in Queensland, you choose an executor who typically manages these steps for you—further ensuring your estate follows your wishes.

9. How Long Does Probate Take?

In Queensland, probate can last anywhere from a few months to over a year. Factors like estate complexity, beneficiary disputes, or a contested Will may prolong it. On average, the process finishes in about 9 to 18 months.

10. Can Probate Be Avoided?

You can often reduce probate by arranging certain assets so they bypass your estate:

- Joint Tenancy: Property owned as joint tenants automatically passes to the surviving owner.

- Beneficiary Designations: Superannuation and life insurance can skip probate if you name direct beneficiaries.

- Family Trusts: Putting assets into a trust means the trust—not you—owns them, so they typically avoid probate. Just move real estate, bank accounts, or investments into the trust correctly.

Many people use living trusts or beneficiary designations to streamline estate administration and lower costs. If you want to minimise probate when you make a Will in Queensland, consider these options early.

Ready to Start Making your Will?

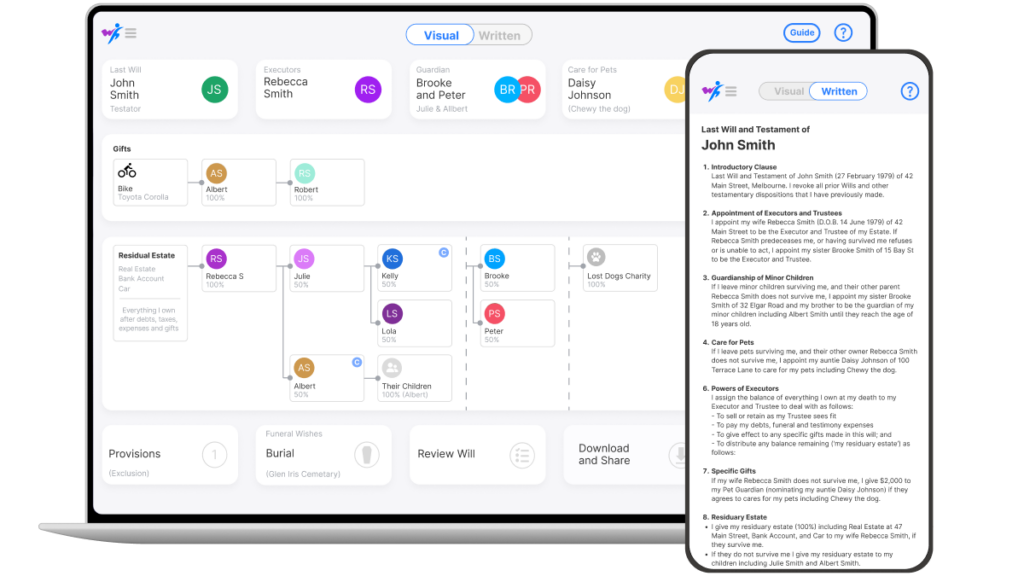

Many people find the first step challenging. If you need help, try Will Hero, an online wills platform available in Queensland. You can sign up for free and create a Will visually, clarifying your wishes with our guides and AI Assistant.

You can also test your Will in various scenarios using our free Scenario Testing account. Upgrade only if you want to review and download your written document. Will Hero makes Will creation more visual, interactive, and even fun—instead of overwhelming.

No matter how you choose to make a Will in Queensland, start now and protect your loved ones and your legacy.

Will Hero helps you make Online Wills in QLD

With a secure, affordable, and lawyer-approved service, we’re making it easier than ever to create your very own online wills in Queensland. Here’s how:

Visual Approach

Make online wills for QLD using visualisations to help you see and understand how your Will works.

AI Assistance

24/7 help to guide you and answer any questions about Wills, estate planning and QLD local laws.

Scenario Testing

Test what would happens to your estate if people in your Will pass away before you.

Legally Valid in Queensland

Designed for Queensland State-specific laws with instructions to make your Will legally valid in QLD.

Lawyer Approved

Drafted by Lawyers.

Personalised by you. You can even make more than just a simple Will.

Great Value

30-day money back guarantee.

No questions asked!

Create Online Wills in QLD - Get Started Now

Ready to secure your legacy and protect your loved ones? Start creating your online wills in Queensland today. Our free trial allows you to experience the process firsthand before committing!

Don’t let the complexities of traditional will-making hold you back. Join the countless people who have discovered the ease and affordability of our convenient online service.

Disclaimer: This blog provides general information only and does not constitute personalised legal advice.