How To Make a Will in Northern Territory (2025 Guide)

A Step-By-Step Guide to Creating a Last Will and Testament In Northern Territory

If you want to make a Will in the Northern Territory, the Wills Act 2000 (NT) outlines all legal requirements. Anyone 18 or older with testamentary capacity can create a valid Will under this law. In this guide, you’ll learn each step—from writing down your wishes to signing with proper witnesses—so you can feel confident about your final decisions.

Why make a Will in NT?

A Will lets you decide how to distribute your property and assets, including real estate, financial accounts, and personal items, after your death. It also helps you plan for your family’s future. For example, you can name guardians for any minor children and give them the security they need if you’re gone.

Without a Will, Northern Territory intestacy rules dictate who inherits your estate. These rules may not match your personal wishes, and they can place extra burdens on your loved ones. By creating a Will in the NT, you keep control over what happens to your assets and reduce stress for those you leave behind.

Legal Requirements to make a Valid Will in the Northern Territory

Under the Wills Act 2000 (NT), you must follow certain steps for your Will to be valid. If you skip them, the courts may declare your Will invalid, which complicates probate and risks intestacy. Here’s what you need to do:

You must be at least 18 years old. Exceptions apply if you’re married or if a court grants permission.

Have testamentary capacity. You need to understand what a Will is, what assets you own, and who might have a claim. This is called having “sound mind.”

Put it in writing. NT does not recognise oral Wills. Your Will must be written—either typed or handwritten—and signed by you in front of two witnesses.

Sign with Two Witnesses. The person making the Will (the testator) must sign while both witnesses watch, all at once. Although a beneficiary can serve as a witness under NT law, that choice may invite extra scrutiny or disputes.

By following these rules, you help ensure your Will is valid and enforceable in the Northern Territory. If you ignore any of these steps, your Will could face legal challenges or end up subject to intestacy laws that might not align with your wishes.

Step-by-Step: How to Make a Will in the Northern Territory

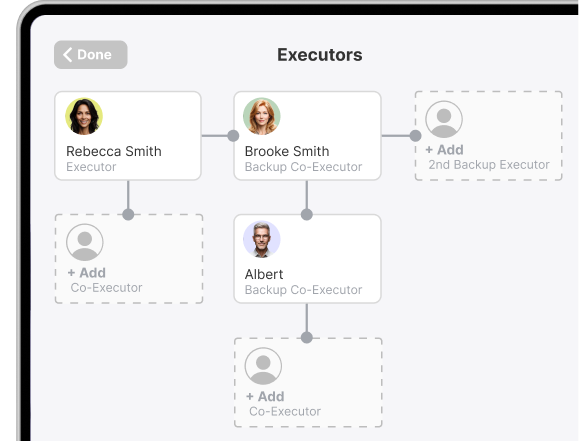

1. Choose an Executor

When you make a Will in the NT, you should pick an executor who will manage your estate after you pass away. This individual handles crucial tasks, such as distributing your assets according to your wishes, paying outstanding debts, and completing legal steps—like applying for a Grant of Probate at the Supreme Court of the Northern Territory.

Choose an Executor who is an organised and reliable adult that is comfortable dealing with financial and legal matters. Many people select a trusted family member, close friend, or professional advisor for this role.

You can also name a backup (alternate) executor if your first choice can’t serve. That way, your estate always has someone with the authority to act, regardless of changing circumstances.

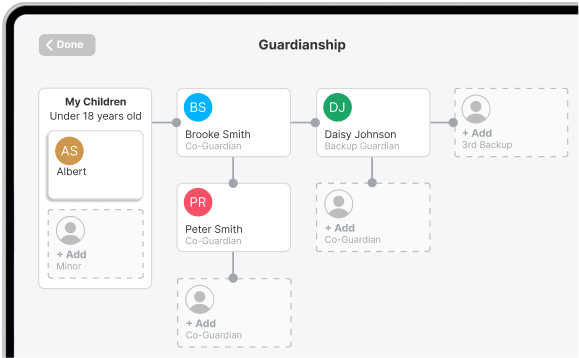

2. Name a Guardian for Minor Children

If you have children under 18, deciding who will look after them if you’re gone is one of the most important parts of making a Will in the NT. By naming a guardian, you give a trusted individual the authority to handle daily decisions about education, healthcare, and overall well-being.

Although this step is optional under the law, most parents see it as essential. If you don’t name a guardian, the courts may assign someone you wouldn’t have chosen.

It’s also a good idea to name a backup guardian if your first choice can’t serve. This extra planning ensures your children get the care you intended, no matter what happens.

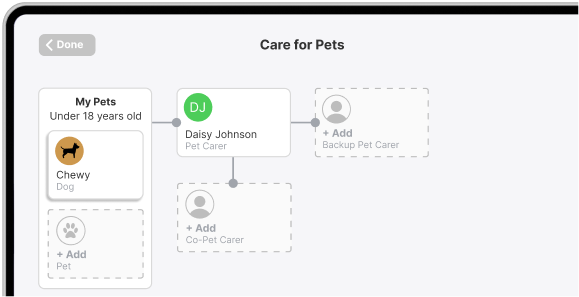

3. Name a Pet Carer

When you make a Will in the NT, you can include instructions for your pets’ care. By appointing a dedicated pet carer, you ensure someone you trust will look after them and manage expenses like food and vet bills.

Although the law doesn’t require you to name a pet carer, doing so keeps you in control of your animals’ future. If you leave this decision open, your executor or a Northern Territory court may assign someone who doesn’t share your preferences.

To protect against unforeseen issues, consider naming a backup carer if your first choice can’t serve. This simple step helps you make sure your pets stay safe and well-cared-for, no matter what happens.

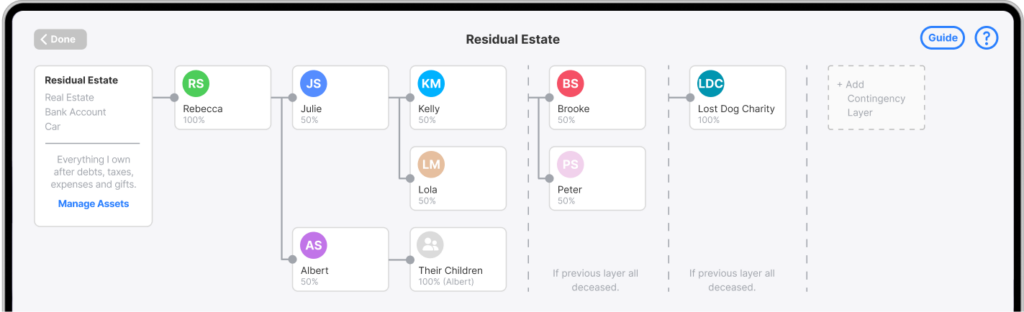

4. Decide who inherits your Residual Estate

After you distribute specific gifts and pay any debts or taxes, whatever remains is your residual estate. This may include real estate, savings, or valuable items you haven’t already assigned.

- Name Your Beneficiaries: You can choose one or multiple beneficiaries—family members, friends, or charities—to receive these assets. Be sure to specify each person’s full legal name and the exact share or percentage they should get.

- List Backup Beneficiaries: If your primary choices can’t inherit for any reason, naming alternate (contingent) beneficiaries ensures your assets still go where you want them.

5. Gifting Specific Items

If you own special belongings—like heirlooms, jewelry, artwork, or collectibles—you may want to leave them to specific people. Clearly identify each item in your Will (including photos, serial numbers, or detailed notes) to prevent disputes or misunderstandings.

Before you make a Will in the NT, create a comprehensive list of your assets so you don’t overlook anything important. This inventory helps you specify who should receive each piece of property, ensuring your gifts reach the right individuals as you intended.

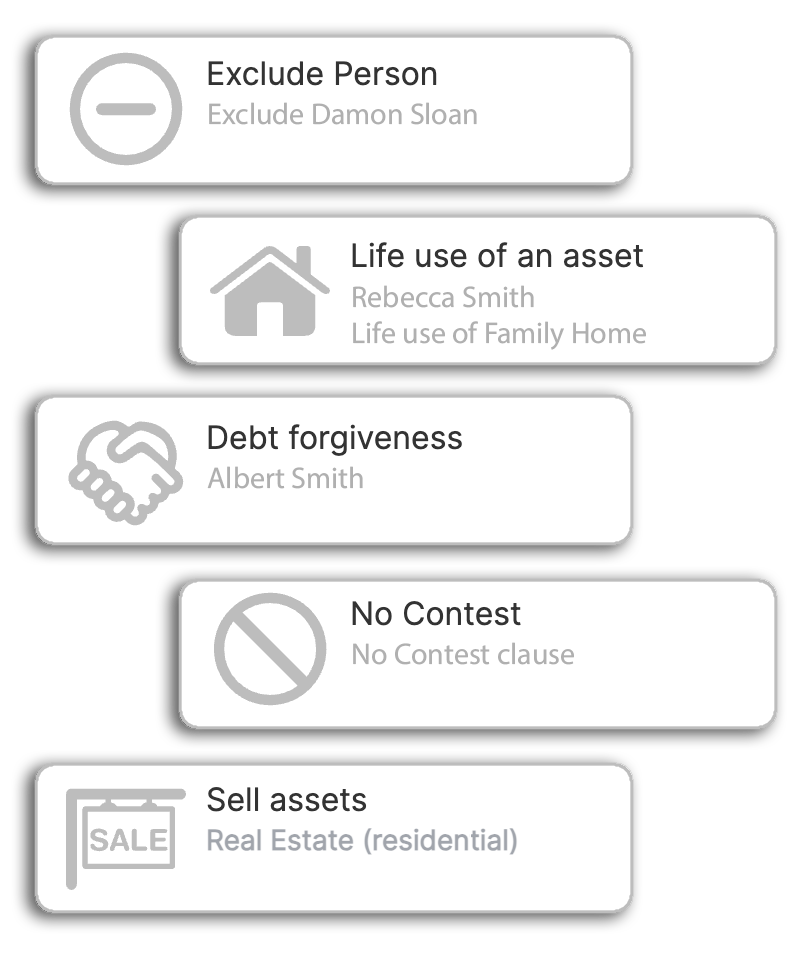

6. Any Additional Instructions or Provisions?

You can add optional clauses, like funeral preferences or instructions to sell certain assets. You might make a gift conditional or set up a trust until beneficiaries reach a specific age (e.g. receive benefit after they reach 25 years old). By laying out these extra details when you make a Will in the Northern Territory, you reduce ambiguity and help ensure your instructions are followed exactly as intended.

Review Your Will

Confirming Roles in Your Will

Before finalizing your Will, check that each named Executor, Guardian, or Pet Carer understands their responsibilities. This proactive step helps prevent confusion and prepares everyone for what lies ahead.

Discuss each role with both primary and backup candidates to avoid surprises later. By clarifying everyone’s duties when you make a Will in the NT, you create a smoother process for everyone involved.

Executors

Guardians

Pet Carers

Test Your Will

After you draft your Will, imagine various “what if” scenarios. For example, what if a main beneficiary dies before you, or a conditional gift doesn’t meet its conditions? By exploring these possibilities, you can find—and fix—any gaps in your estate plan.

By testing these situations before you finalize your Will in the Northern Territory, you can update any sections that need more clarity. This proactive approach ensures your final document aligns with your true wishes, even if life’s circumstances change.

Signing Your Will

Signing Your Will In Front of Witnesses

After you draft your Will, print and sign it as the next crucial step. When you make a Will in Queensland, follow these rules to ensure validity:

Witness Requirements

- Have at least two witnesses watch you sign the Will simultaneously.

- They must be 18 or older and understand they’re witnessing your signature.

- Although Queensland law allows a beneficiary to witness, doing so may add extra legal steps—so it’s best to use disinterested witnesses.

Once you sign, both witnesses must also sign, confirming they saw you and that you appeared to have capacity (sound mind).

Is Notarisation Required?

You don’t need a notary for Wills in Australia, including Queensland. As long as your Will meets the witness requirements, the Court accepts it as valid without a seal or stamp.

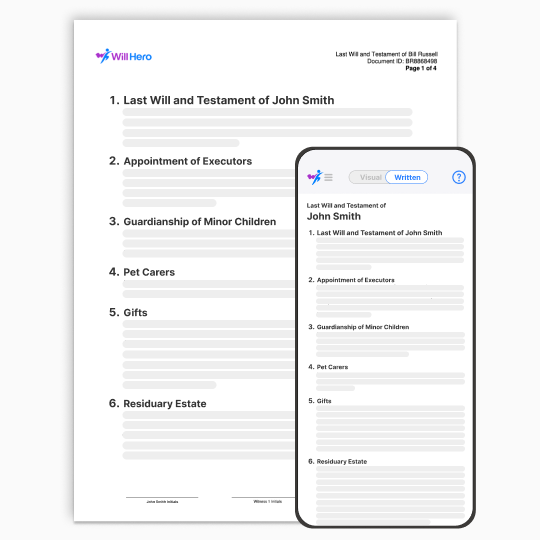

What about Online Wills in NT?

If you use any Online Will platform in the Northern Territory to make your Will, it is essential that your Will is printed and signed according to these instructions. Having a Will online in the Northern Territory that has NOT been printed and signed will not be considered valid.

Storing Your Will

Keep Your Will Safe

NT doesn’t operate a registry for living Wills, therefore you must protect the original signed document. Here are three common storage methods to consider when you make a Will in the NT:

Store at Home

Keep your Will at home, ideally in a fireproof safe.

With an Attorney

If you worked with a lawyer, they may offer to store the original Will in a secure location for you.

Trusted Person

You can also leave the Will with a trusted person who knows its importance and will keep it safe from loss or damage.

Always tell your executor (and any backups) where you’ve placed the original Will. If they can find it quickly, they’ll avoid legal or administrative delays when your estate needs settling.

Although online wills in NT (digital copies) are handy for reference, only the original signed Will carries legal weight in the Northern Territory. Be sure your executor knows exactly where to find it to avoid complications.

FAQs: Making a Will in the Northern Territory

1. What Are My Options for Creating a Will in the Northern Territory?

In NT, you have a few ways to make a Will:

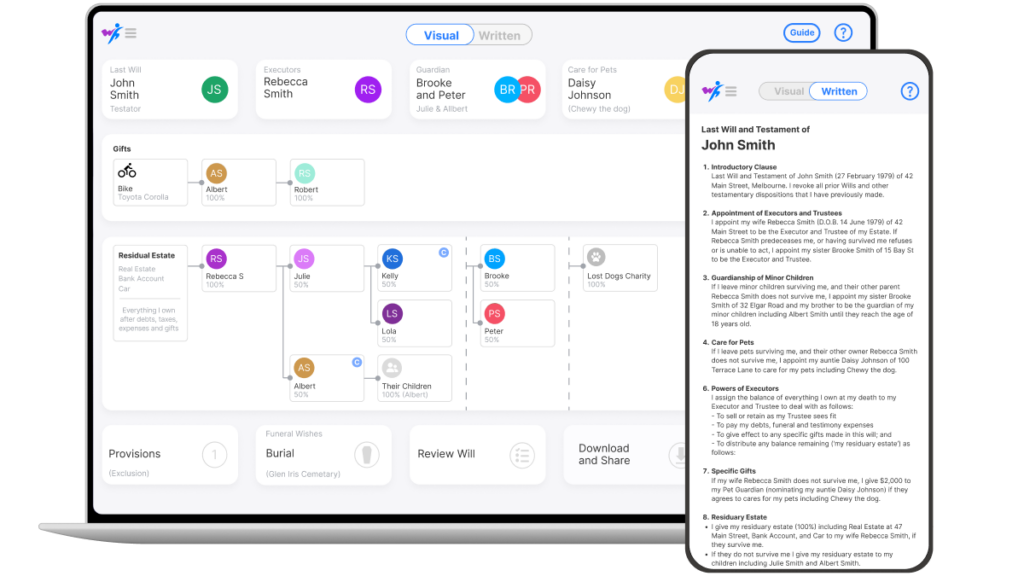

- Use an Online Platform: For simpler estates, a service like Will Hero offers an affordable, convenient way to create a valid Will online in NT. Our visual interface walks you through each step to ensure you cover all essentials.

- Hire a Lawyer: Ideal if your estate is large or complex, or if you want personalised legal guidance. Lawyers can assist with estate tax planning, trusts, and other specialised issues.

- Handwrite Your Will: As long as you meet the witnessing requirements (see FAQ #3), a handwritten Will can be legally valid in WA.

2. Do I Need a Lawyer to Make a Will in the Northern Territory?

No, you don’t need to hire a lawyer to create a valid Will in the Northern Territory. If your estate is straightforward and your wishes are clear, you can draft a Will online or even handwrite one. However, if your estate is complex, or you have concerns about tax planning or trusts, consulting a legal professional provides extra peace of mind.

3. Are Handwritten Wills Valid in the Northern Territory?

Yes. When you make a Will in the Northern Territory, handwriting it is perfectly valid if you follow the correct steps. Under the Wills Act 2000 (NT), the testator must sign any typed or handwritten Will in front of two witnesses who watch at the same time.

If a handwritten Will doesn’t meet these requirements, the NT’s Supreme Court may use its “dispensing power” to declare it valid, but that route is uncertain and can be expensive. To avoid complications, use two independent witnesses from the outset—no matter how you create your Will.

4. Is there Any Inheritance Tax in the Northern Territory?

Australia, including the NT, does not levy inheritance or estate taxes (“death duties”). However, you might owe capital gains tax (CGT) if you sell inherited property, shares, or other assets for a profit.

Receiving an inheritance doesn’t trigger tax by itself, but large or complex estates (especially those involving property or investments) may carry extra tax considerations. If you have questions about CGT or other tax rules, consult a qualified professional in the NT to clarify your obligations.

5. Do I Need to Notarise My Will in the Northern Territory?

No. The Northern Territory does not require notarization for a valid Will. You only need to meet witnessing requirements—two witnesses must watch you sign, and they must sign in your presence. As long as you comply with the Wills Act 2000 (NT), your Will is considered valid without a notary.

6. Can I Change My Will After It’s Signed?

Absolutely. If you have testamentary capacity (sound mind), you can revise your Will at any point. You can either:

- Add a Codicil: A short legal amendment that updates your existing Will. Sign and witness it just like the original.

- Create a New Will: Draft a fresh document that revokes all earlier Wills and codicils. After you sign, destroy old copies to avoid confusion.

If your changes are complex—such as setting up a trust or altering major bequests—consult a Northern Territory legal professional to ensure your revisions hold up.

7. What Happens if I die without a Will?

If you die intestate (without a Will), Northern Territory intestacy laws determine how your estate is divided. Usually, your closest relatives inherit, but if you have no immediate family, the government may claim your assets.

A court may also appoint a guardian for any minor children you leave behind, potentially overriding your personal preferences. By creating a Will in the NT, you keep control over who manages your estate and who cares for your children.

8. What is Probate?

Probate is the legal process that confirms your Will’s validity and oversees the proper distribution of your estate.

If you die without a Will, NT intestacy laws determine who inherits. In the Northern Territory, the Supreme Court (via its Probate Office) issues a Grant of Probate—your executor usually applies for this. Here’s how it works:

Filing the Will

The executor files the Will with the Supreme Court of NT, along with a petition to open probate. If no Will exists, they submit a petition for intestate succession.Appointing an Executor

If a valid Will names an executor, that person manages the estate. If the Will lacks an executor—or if there’s no Will—the court appoints an administrator.Inventory of Assets

The executor identifies and values the deceased’s property—like bank accounts, investments, personal belongings, and debts.Paying Debts and Taxes

Before distributing the estate, the executor settles all debts, taxes, and expenses (e.g., mortgages, credit card bills, medical costs).Distributing the Estate

Once everything is paid, the executor distributes the remaining assets to the beneficiaries named in the Will. If no Will exists, the estate goes to heirs under NT’s intestacy rules.Closing the Estate

After meeting all obligations, the executor files a final petition to close the probate process.

When you make a Will in the Northern Territory, you choose an executor who typically manages these steps on your behalf.

9. How Long Does Probate Take?

Probate in the Northern Territory can run from a few months to over a year. Key factors include:

- Estate Complexity: Multiple properties, businesses, or foreign assets can prolong the process.

- Beneficiary Disputes: Contested Wills often lead to court proceedings, extending the timeline.

- Court Schedules: The NT Supreme Court’s timeline also affects how quickly probate moves.

In straightforward cases, where there are no disputes or missing paperwork, probate may conclude more quickly—sometimes within a few months.

10. Can Probate Be Avoided?

You can’t always bypass probate, but you can reduce it by arranging certain assets so they won’t enter your estate. Popular strategies include:

- Joint Tenancy: Property held in joint names passes directly to the surviving co-owner(s).

- Beneficiary Nominations: Superannuation, life insurance, and some bank accounts let you name recipients who inherit without probate.

- Family Trusts: Assets you transfer to a trust belong to the trust, not to you—so they generally don’t go through probate.

If streamlining probate is important when you make a Will in the NT, talk to a legal advisor early. Proper planning can save your loved ones time, money, and stress.

Ready to Start Making your Will?

For many, taking the first step is the hardest part. If you need help, try Will Hero? You can sign up for free and draft a Will visually. Clarify your wishes as you learn about Wills and estate planning with our guides and AI Assistant.

You can also test your Will under different scenarios using a free Scenario Testing account. Upgrade only if you want to review and download the written document. Will Hero aims to make Will creation more visual, interactive, and even fun—instead of difficult or daunting.

No matter how you choose to make your Will, start today and protect your loved ones and your legacy.

Disclaimer: This blog provides general information only and does not constitute personalised legal advice.